Written by Chloe Karis/@chloekaris

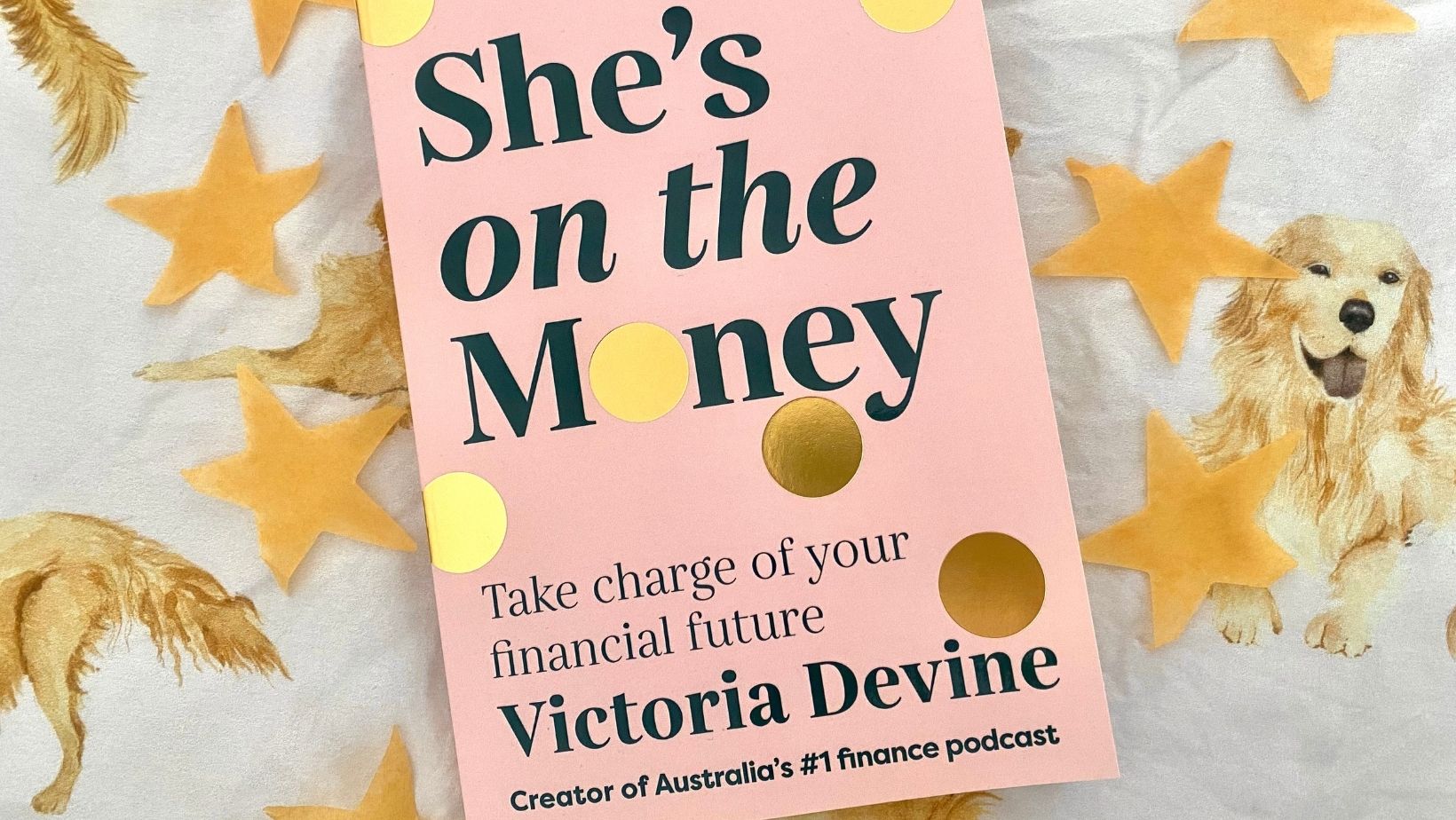

Author and host, Victoria Devine, is a multi-award-winning financial adviser who’s helping millennial’s reach their money goals, define their spending habits and become confident with their own money. Victoria hosts her podcast She’s on the Money which is Australia’s #1 Business Podcast and recently released her book She’s on the Money.

If you’re wanting to take control of your money, She’s on the Money is the book for you. From learning about different debts (student debts are okay debts!), managing your cash flow and budgeting, this book covers it all. There are options to write on the pages and do activities to learn more about your habits. By the end of it, you’ll feel like a pro and know you can be in control of your money.

Victoria said she knew this was the next step for her. She had her community wanting a book and she figured it was a good idea and thankfully a publisher had approached her about doing one. “I was really lucky in that aspect” of working with a publisher from the very beginning of the book process. She hopes readers “get the confidence to start their financial journeys” when reading the book. “Regardless of their history, money story, their current financial situation, that they have the power to change that themselves,” she said.

If you’re struggling with cash flow and budgeting, you’ll appreciate these sections in the book, along with the money stories. Victoria was a uni student and had the same struggles, “it’s not uncommon and to be honest, just being in control of your budget and cash flow is really powerful”. Students can sometimes put too much pressure to save and invest to get ahead. She said, “It’s okay to not be saving much because you’re prioritising studying.”

Speaking of investing, Victoria said it’s important to be aware of it and educate yourself. It’s not important to start investing now if it’s too much pressure or you can’t afford it. “You don’t have to start unless you’re feeling genuinely ready.”

Victoria said being aware of the money coming into your account is important, “no matter how small it is” even if you sold something online. “Jumping around for a good deal” is another recommendation or seeing the getting the sales at one supermarket and finishing your shop at another. “Anything that can keep your costs low while at uni is valuable” like having housemates, share rides “because all the little things add up”.

She said financial security is important but while being a student “you feel like you have to keep up” with other people. Don’t put pressure on yourself to think you need to always go out, pay for drinks and have a new outfit. How can we overcome that FOMO when we think we will miss out? “The most important thing is knowing your own values,” she said. If you did want to go to that event all your friends are going to, do you even like that event? “Or do you just want the social aspect?” If you did want to go “you should have already been saving for it, but I think getting swept up in things last minute is very easy” she said. “You might not be able to afford the whole thing [event], but can you afford to go out for a drink after to get the social interaction.” She said it’s helpful to think of other ways to get involved without needing to “pay for the big ticket item”.

For the buy now, pay later companies, Victoria recommends the best way to utilise them is to wonder “why you need to use them in the first place”. Will you want this item in a month when you’ve paid it off? Sometimes you can’t avoid it for a doctor’s appointment or a new laptop for uni. But those companies “are a really slippery slope” and nobody gets them with the intention of getting into debt. Ask yourself and “wonder why you feel you need to access a program like that, like they’ve never existed before why do you need it today?”

Now we know ways how to overcome FOMO, how to save those extra dollars and to try to avoid the buy now, pay later companies, but can we still achieve what we want with a student debt behind us? “Absolutely,” Victoria said, “Debt is just a hurdle that we need to get across.” Make a plan with your budget and cash flow and commit to what we want to do. And yes, according to Victoria, student debts are ‘okay’. “It has no time limit on how quickly you need to pay it back and if you don’t earn enough you don’t have to pay it back.”

She’s on the Money is perfect for anyone as it’s easy to read and understand for them to reach their financial freedom. I highly recommend grabbing yourself a copy and giving it a read. If you don’t have the money to get this book, that’s okay! Victoria said you can listen to her podcast “because it’s free and unique. Students love free stuff”. We all can relate to this because how often (when we could) walk down Bowen Street or go to Alumni Courtyard for some free food and drinks? If podcasts aren’t your thing try out the free downloadable budget, “it’s a really helpful tool”.

If you’re finishing uni, “have a think about the superannuation that you are choosing and remember that superannuation is 10% of your money that is invested on your behalf” which you have control of! If you’ve had multiple jobs, you likely have several superannuation accounts and Victoria said to “look at whether you need to consolidate those and just pick one”. She said, “It’s probably the first time in your career that you’re going to be seriously and significantly contributing to it, so we need to start caring for that now, because that is a massive investment.”

You can buy She’s on the Money at any good bookstore online or in-store.